income tax calculator philippines

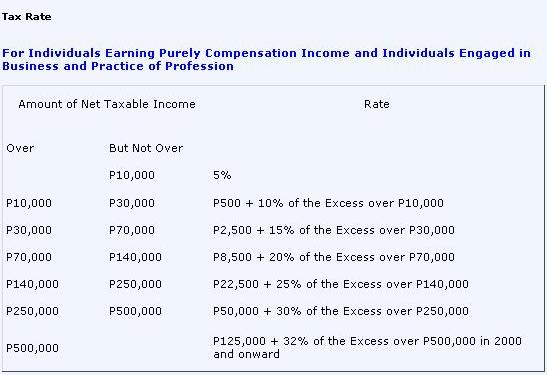

Income tax law provided in Tax Code of 19997 governs income tax procedures in Philippines resident citizens. Salary and allowances of husband arising from employment.

Tax Liability What It Is And How To Calculate It Bench Accounting

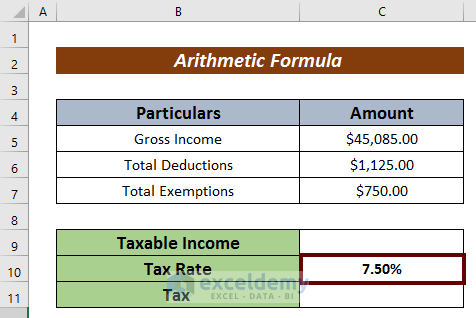

Taxable Income per Year.

. If you make 14950 a year living in Philippines you will be taxed 2916That means that your net pay will be 12034 per year or 1003 per month. To access Withholding Tax Calculator click here. Salary of PHP 652000 living allowances of PHP 100000 and housing benefits 100 of PHP 300000.

Ang tax calculator na ito ay pawang para sa mga sumasahod lamang dahil sa ibang sistema ng pababayad ng buwis para sa mga self-employed at propesyunal tulad ng mga doktor. If you make 40000 a year living in Philippines you will be taxed 4139. Taxumo is the best option for digital tax filing in the Philippines.

Philippine Public Finance and Related. The Annual Wage Calculator is updated with the latest income tax rates in Philippines for 2023 and is a great calculator for working out. Republic of the Philippines.

Philippines Annual Salary After Tax Calculator 2023. That means that your net pay will be 64311 per year or 5359 per month. Your average tax rate is 195 and your.

It is the 1 online tax calculator in the Philippines. If you make 70000 a year living in Philippines you will be taxed 5689. The Monthly Wage Calculator is updated with the latest income tax rates in Philippines for 2022 and is a great calculator for working.

It is an ideal choice for small-scale business owners self-employed. Income Tax Calculator Philippines Who are required to file income tax returns. All content is in the public domain.

That means that your net pay will be 35861 per year or 2988 per month. This guide will teach you how to use the BIR Tax. To estimate the impact of the TRAIN Law on your compensation income.

Philippines Residents Income Tax Tables in 2023. Your average tax rate is 81. Calculate your income tax in Philippines salary deductions in Philippines and compare salary after tax for income earned in Philippines in the 2022 tax year using the Philippines salary.

Tax Changes You Need to Know on RA 10963 TRAIN 2017 Philippine Capital Income and Financial Intermediation Statistics. Your average tax rate is 104. Its important to know how to compute income tax in the Philippines especially if you are an individual or business owner.

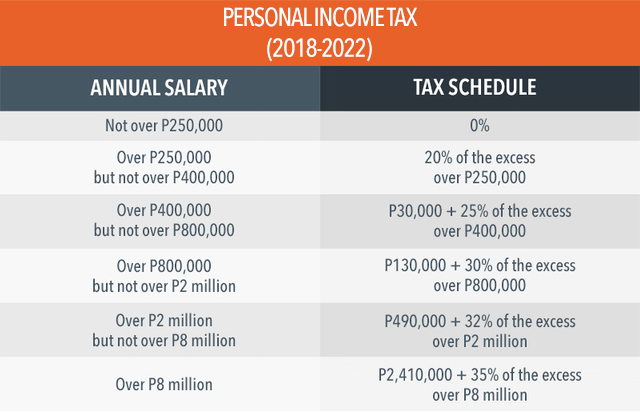

Income Tax Rate Year 2023 onwards P250000 and below. The new income tax rates from year 2023 onwards as per the TRAIN law are as follows. Philippines Monthly Salary After Tax Calculator 2022.

Income Tax Rates and Thresholds Annual Tax Rate.

How To Calculate Net Pay Step By Step Example

How Much Does A Small Business Pay In Taxes

How To Compute Your Income Tax Using Online Tax Calculator An Ultimate Guide Filipiknow

Income Tax Formula Excel University

Income Tax Calculator Know How To Calculate Income Tax For The Financial Year Housing News

Filipino Workers And Tax Computations In The Philippines Taxumo File Pay Your Taxes In Minutes

Tax Calculator Compute Your Income Tax

Formula For Calculating Withholding Tax In Excel 4 Effective Variants

Salary Paycheck Calculator Calculate Net Income Adp

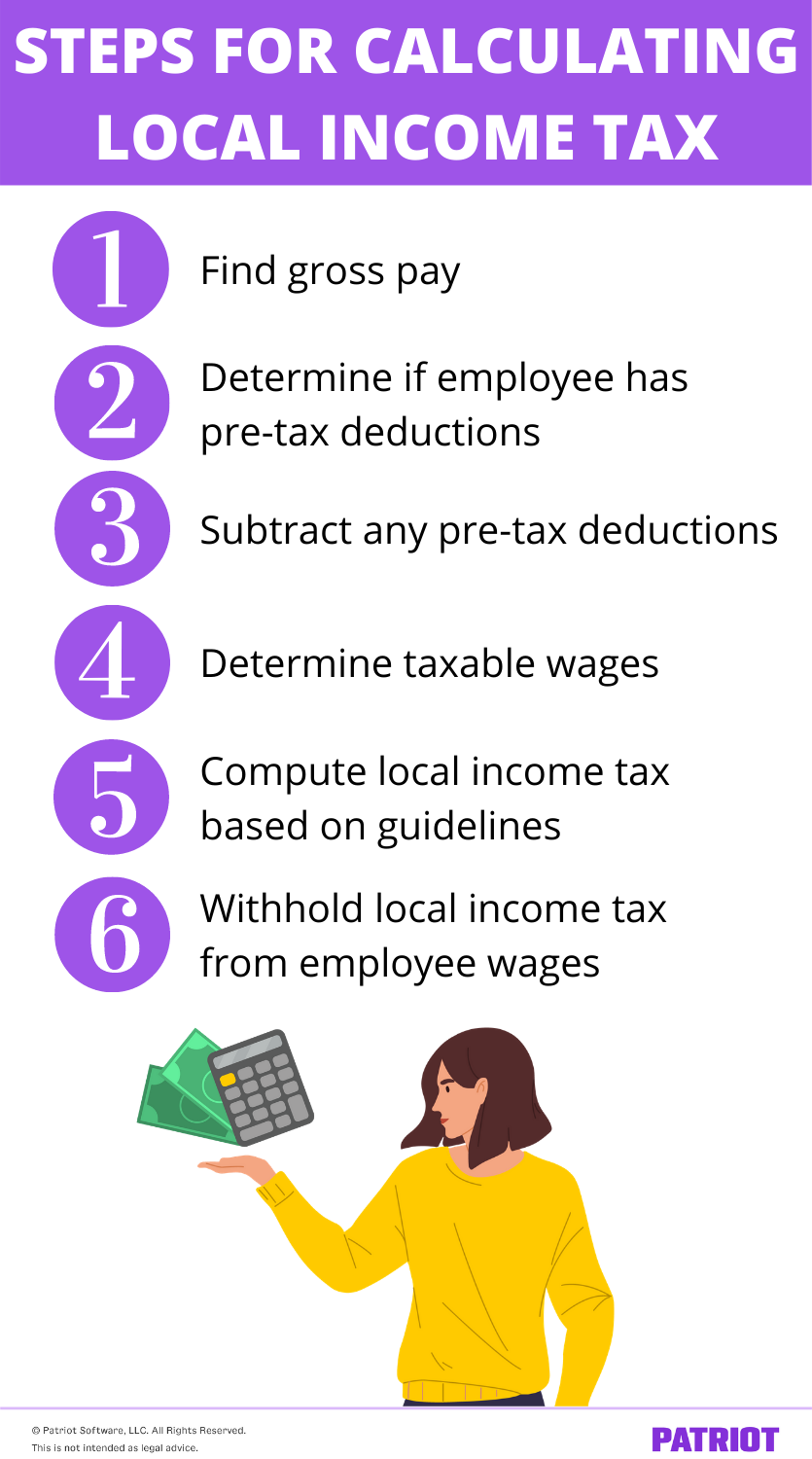

How To Calculate Local Income Tax Steps More

Tax Rate Business Tips Philippines Business Owners And Entrepreneurs Guide

Resources Uric Tax Accountants

New Income Tax Table 2022 In The Philippines

Tax Calculator Compute Your New Income Tax

Guide On How To Compute Tax Refund Based On Train Law Sprout Solutions