when to expect unemployment tax break refund turbotax

Assuming you werent eligible for the tax break on your original return youll. For anyone expecting an extra refund you can now go on the IRS website and view your account transcript and it will show your refund amount and.

Free Online Tax Filing E File Tax Prep H R Block

The IRS is recalculating refunds for people whose AGI is 150K or below and who filed before the tax law that changed the amount of unemployment that is taxable on a federal.

. Adjusted gross income and for unemployment insurance received during 2020. Coronavirus Unemployment Benefits and Tax Relief. The tax break is for those who earned less than 150000 in.

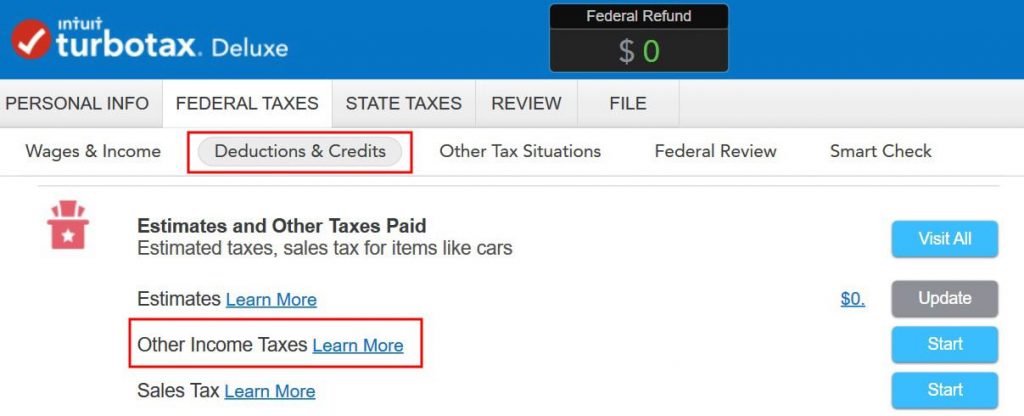

If you received unemployment benefits last yearyou may be eligible for a refund from the IRS. The American Rescue Plan makes the first 10200 of unemployment income tax-free for households with income less than 150000 for. The first10200 in benefit income is free of federal income tax per legislation.

The IRS has not announced when the next batch will be sent. So you filed your tax return through TurboTax and became eligible for the unemployment compensation. The IRS is recalculating refunds for.

Unemployment Tax Break Update. Losing your job can be a difficult and uncertain time. The IRS and some states consider unemployment compensation to be taxable income that you are required to report on your federal tax return.

Here are six tax tips to keep in mind while youre looking for that new job. The most recent batch of unemployment refunds went out in late July. First Time Filing for Unemployment.

The tax exemption for 10200 in unemployment benefits currently only applies to unemployment income you collected in 2020 even though the bill also extended weekly 300.

Intuit Turbotax 2022 Tax Year 2021 Review Pcmag

Turbotax Vs H R Block Which Online Tax Service Is Best

Tax Calculator Refund Return Estimator 2022 2023 Turbotax Official

Turbotax H R Block Expect Delays On Stimulus Unemployment Tax Break

Unemployment Center The Turbotax Blog

Intuit Turbotax 2022 Tax Year 2021 Review Pcmag

Turbotax H R Block Need Time To Account For 10200 Unemployment Tax Break

Turbotax Unemployment Exemption Tax Companies Still Working Changes Kfor Com Oklahoma City

Not Sure If I Am Owed The Unemployment Tax Refund R Irs

How To Claim Your Unemployment Tax Break On 2020 Benefits

Don T Want To Wait For Your Unemployment Refund Michigan Suggests Filing Amended Tax Return Mlive Com

Unemployment 10 200 Tax Break Some States Require Amended Returns

The Best Online Tax Filing Software For 2022 Reviews By Wirecutter

Overpay Your Taxes To Buy 5 000 In I Bonds

10 Tax Tips For The Suddenly Unemployed Turbotax Tax Tips Videos

How To Get A Refund For Taxes On Unemployment Benefits Solid State

Turbotax H R Block Update Software For 10 200 Unemployment Tax Break