boulder co sales tax rate 2020

With local taxes the total sales tax rate is between 2900 and 11200. If your business is located in a self-collected jurisdiction you must apply for a sales tax account with that city.

California Sales Tax Rates By City County 2022

Para asistencia en español favor de mandarnos un email a.

. You can print a 8845 sales tax table here. The Colorado state sales tax rate is currently. The ESD tax is on top of the City of Boulder sales tax rate of 386.

Some cities and local. The Colorado sales tax rate is currently. The rate is comprised of individual voterapproved county sales and use tax ballot measures adopted to support county programs in conservaon transportaon offender management nonprofit capital.

Sales Use Tax Rate Changes Effective July 1 2022. The 2020 Boulder County sales and use tax rate is 0985. Boulder County does not have a sales tax licensing requirement as our sales tax is collected by the Colorado Department of Revenue.

This document lists the sales and use tax rates for all Colorado cities counties and special districts. This is the total of state county and city sales tax rates. 2020 rates included for use while preparing your income tax deduction.

For tax rates in other cities see. Boulder in Colorado has a tax rate of 885 for 2022 this includes the Colorado Sales Tax Rate of 29 and Local Sales Tax Rates in Boulder totaling 595. Boulder County CO Sales Tax Rate.

About City of Boulders Sales and Use Tax. The Boulder sales tax rate is. Has impacted many state nexus laws and sales tax collection requirements.

Select the Colorado city from the list of popular cities below to see its current sales tax rate. The state sales tax rate in Colorado is 2900. The Boulder County Remainder Colorado sales tax is 499 consisting of 290 Colorado state sales tax and 209 Boulder County Remainder local sales taxesThe local sales tax consists of a 099 county sales tax and a 110 special district sales tax used to fund transportation districts local attractions etc.

The December 2020 total local sales tax rate was 8845. To find all applicable sales or use tax rates for a specific business location or local government visit the How to Look Up Sales Use Tax Rates web page. The December 2020 total local sales tax rate was 8845.

A county-wide sales tax rate of 0985 is applicable to localities in Boulder County in addition to the 29 Colorado sales tax. The citys Sales Use Tax team manages business licensing sales tax use and other tax filings construction use tax reconciliation returns and various tax auditing functions. Salestaxbouldercoloradogov o llamarnos a 303-441-4425.

NV Rates Calculator Table. The 2018 United States Supreme Court decision in South Dakota v. Determining the increase in base revenue can be complicated by the implementation of temporary tax rate increases.

Some cities and local governments in Boulder County collect additional local sales taxes which can be as high as 51. This is the total of state and county sales tax rates. Boulder CO Sales Tax Rate.

The Boulder County Sales Tax is 0985. This page does not contain all tax rates for a business location. The December 2020 total local sales tax rate was 8845.

Tax Rates Licensing Boulder Countys tax rate is 0985 This tax must be collected in addition to any applicable city and state taxes. The latest sales tax rate for Boulder City NV. Boulder City is in the following zip codes.

The minimum combined 2022 sales tax rate for Boulder Colorado is. Wayfair Inc affect Colorado. Colorado has recent rate changes Fri Jan 01 2021.

The Boulder Sales Tax is collected by the merchant on all qualifying sales. 2055 lower than the maximum sales tax in CO The 8845 sales tax rate in Boulder consists of 29 Colorado state sales tax 0985 Boulder County sales tax 386 Boulder tax and 11 Special tax. ICalculator US Excellent Free Online Calculators for Personal and Business use.

As of July 1 2020 tobacco retailers must collect and remit the 40 sales tax on Electronic Smoking Devices including any refill cartridge or any other ESD components. The Boulder County Sales Tax is 0985. The County sales tax rate is.

What is the sales tax rate in Boulder Colorado. This rate includes any state county city and local sales taxes. There is no provision for any po rtion to be retained as a vendor fee.

Did South Dakota v. July to December 2020. The Boulder Colorado sales tax is 885 consisting of 290 Colorado state sales tax and 595 Boulder local sales taxesThe local sales tax consists of a 099 county sales tax a 386 city sales tax and a 110 special district sales tax used to fund transportation districts local attractions etc.

It also contains contact information for all self-collected jurisdictions. This web page contains changes to existing sales or use tax rates. The December 2020 total local.

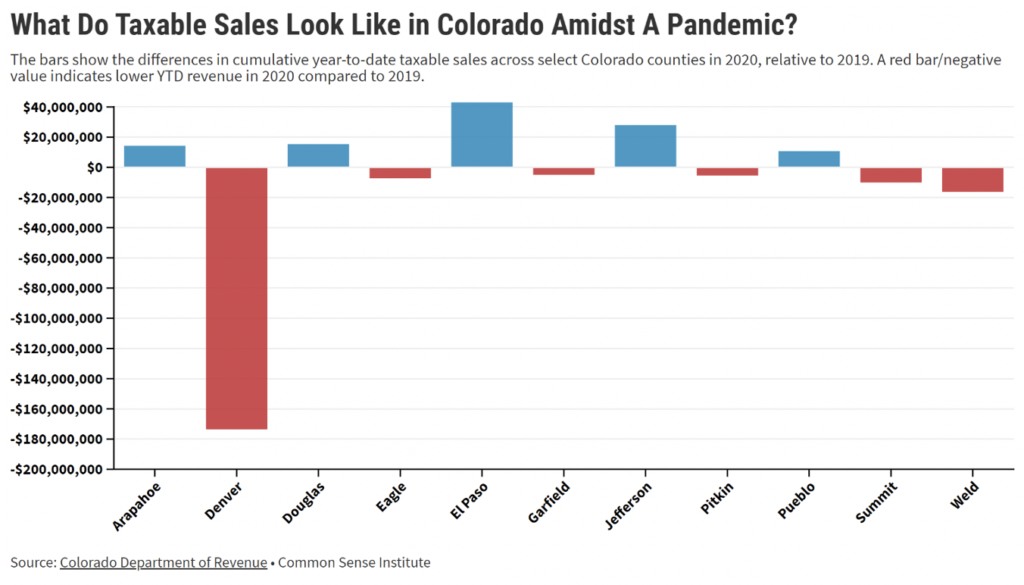

The COVID-19 pandemic resulted in significant business shut-downs in the final week of March 2020 and all of April 2020 and May 2020. 2055 lower than the maximum sales tax in CO. The Boulder County sales tax rate is.

NV is in Clark County. For tax rates in other cities see Colorado sales taxes by city and county. The minimum combined 2022 sales tax rate for Boulder County Colorado is.

The current total local sales tax rate in Boulder County CO is 4985. The current total local sales tax rate in Boulder CO is 4985. The 2020 Boulder County sales and use tax rate is 0985.

The city had two recently approved temporary increases for dedicated purposes.

Vape E Cig Tax By State For 2022 Current Rates In Your State

File Sales Tax By County Webp Wikimedia Commons

Colorado And Denver Marijuana Taxes Rank Near Top And May Grow Axios Denver

Wisconsin Sales Tax Rates By City County 2022

Taxes In Boulder The State Of Colorado

Colorado Sales Tax Rates By City County 2022

Sales And Use Tax City Of Boulder

How To Ensure The Right Sales Tax Rate Is Applied To Each Transaction

Sales Tax Revenue In Colorado Cities Since Start Of The Pandemic Common Sense Institute

Sales Tax Revenue In Colorado Cities Since Start Of The Pandemic Common Sense Institute

Taxpayer Information Henderson Nv

Sales Tax Revenue In Colorado Cities Since Start Of The Pandemic Common Sense Institute

Armco Rebrands As Aces Quality Management Send2press Newswire Risk Management Financial Institutions Consumer Lending

How To Ensure The Right Sales Tax Rate Is Applied To Each Transaction