estate tax exemption 2022 proposal

The estate tax exemption is often adjusted annually to reflect changes in inflation every year. The proposed regulations are complex and may change the anticipated results of several other estate planning strategies.

The effective date of these tax rates and the tax bracket is January 1 2022.

. In Progress property values exemptions and other supporting information on this page are part of the working tax roll and are subject to change. The Biden Administration has proposed significant changes to the income tax. This exemption does not entitle any person to a refund of any tax heretofore paid on the transfer of property of the nature.

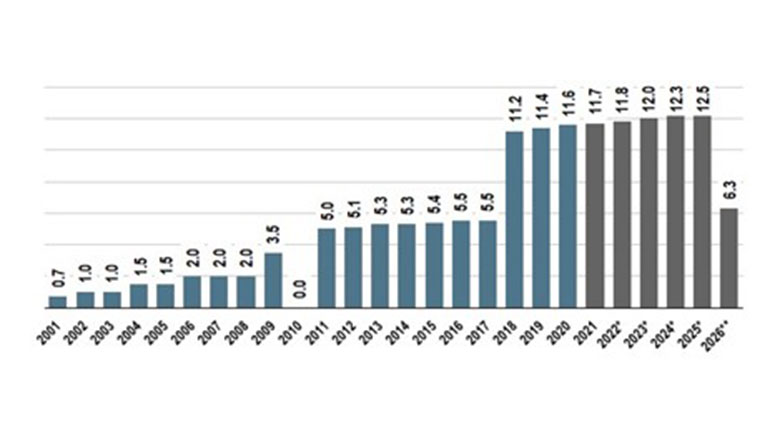

The package proposed reducing the current 117 million estategift tax exemption by 50 percent on January 1 2022 eliminating the use of valuation discounts for non. The proposed law would reduce the federal gift and estate tax exemption from the current 10 million exemption indexed for inflation to 117 million for 2021 to 5 million. 2022 Notice of Proposed Property Taxes.

The proposed 995 Act never materialized. The Department of Finance administers a number of benefits for property owners in the form of exemptions and abatements. The proposal would double the federal estate tax exemption to 11 million per person 22 million per couple and remove the tax completely by 2024.

An MLive file photo of a single-family affordable home built through a a community land trust in the Baxter. The Proposal reduces the current 11700000 per person unified gift and estate tax exemption by approximately one half to approximately 6030000. Get information on how the estate tax may apply to your taxable estate at your death.

The proposals reduce the federal estate and gift tax exemption from the current 117 million inflation-adjusted for 2021 to 5 million inflation-adjusted effective January 1. However the change to the top capital gains rate which is increased to 25 is effective. Exemptions lower the amount of.

08 2022 851 am. Under the current tax law the higher estate and gift tax exemption will Sunset on December 31 2025. Benefits for Property Owners.

The gift tax exemption will be limited to 1000000 beginning on January 1 2022. The proposed regulations are complex and may change the anticipated results of several other estate planning strategies. When the Tax Cuts and Jobs Act of 2017 was passed.

The current 2021 gift and estate tax exemption is 117 million for each US. Estate or estates is exempt from the New Jersey Inheritance Tax. 08 2022 815 am.

The federal estate tax exemption for 2022 is 1206 million. 2022 Estate Gift Tax Exemption Exclusion. The two agencies that issue these agreements are NYC Industrial Development Agency IDA and NYC Economic Development Corporation EDC.

Estates of decedents survived by a spouse. When the Tax Cuts and Jobs Act of 2017 was passed. Decrease of Valuable Estate and Gift Tax Exemptions Effective January 1 2022 Time is now of the essence for utilizing gift and estate tax exemptions.

Through these agreements properties are. Starting January 1 2026 the exemption will return to 549 million. The IRS issued proposed regulations Tuesday REG-118913-21 that would provide an exception to the anti-clawback special rule that preserves the benefits of the temporarily.

The good news is that. Presently the estate tax and gift tax exemptions are both set at 11700000 less whatever. Grantor trusts retain the same benefits and the Generation Skip Tax is equivalent to the estate.

11700000 in 2021 and 12060000 in 2022.

Estate Taxes Under Biden Administration May See Changes

Gift Tax Exemption Lifetime Gift Tax Exemption The American College Of Trust And Estate Counsel

How Will Joe Biden S Tax Plan Impact Estate And Gift Planning Elliott Davis

The Federal Gift Tax Applies Whenever You Give Someone Other Than Your Spouse A Gift Worth More Than 15 000 Tuition Payment Federal Income Tax Tax

Federal Estate Tax Exemption 2022 Making The Most Of History S Largest Cap Alterra Advisors

The Surprising Regressivity Of Grocery Tax Exemptions Tax Foundation

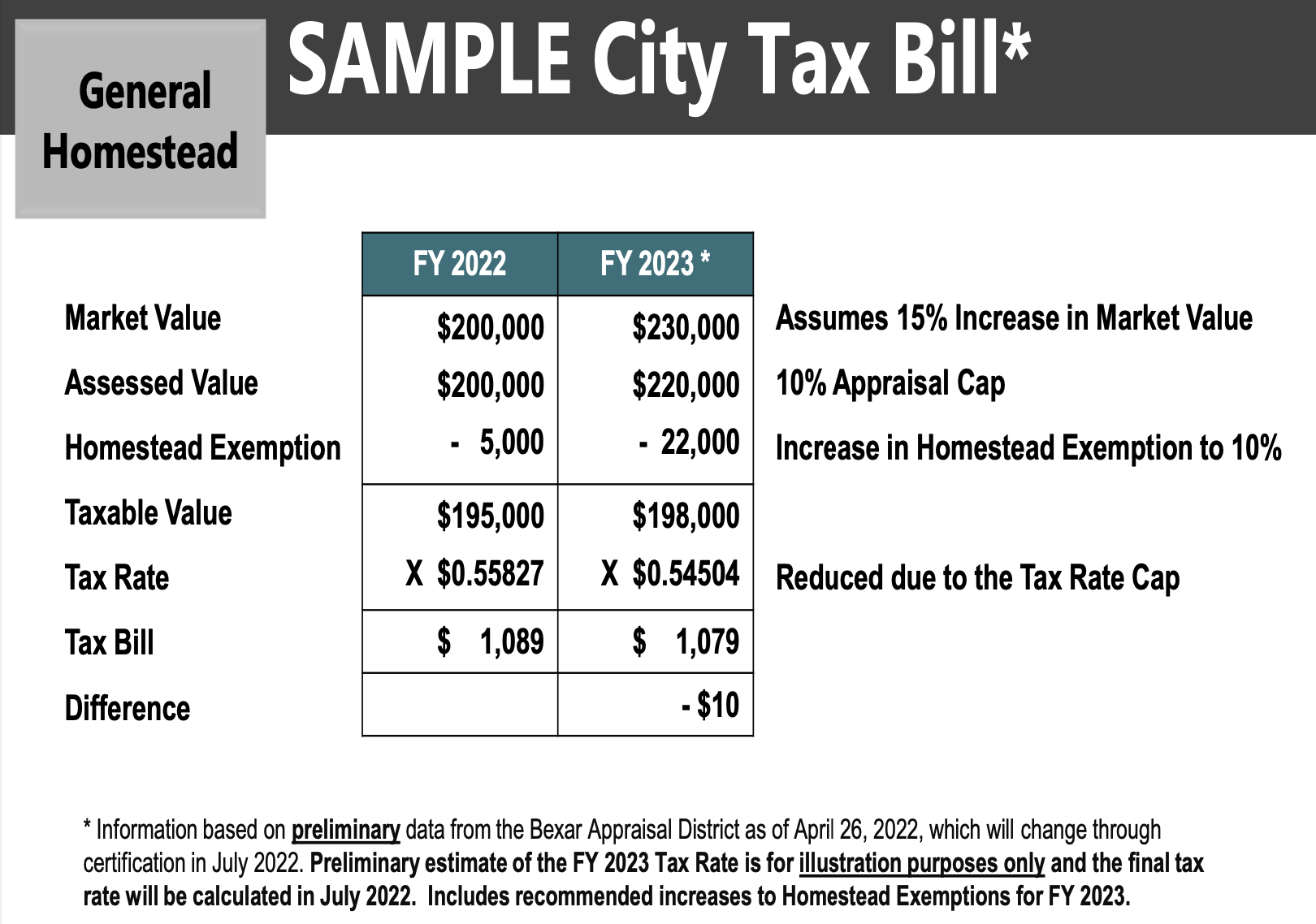

Sa May Be Forced To Cut Property Tax Rate Council Also Considering Raising Homestead Exemption

Estimate Your 2023 Property Tax Today Department Of Revenue City Of Philadelphia

Biden Greenbook Estate Tax Proposals Should You Care

Brad Williams Recommended Estate Tax Changes To Make Before 2022 Ends Supply House Times

Top Estate Planning Law Changes For 2022 Law Offices Of Daniel Hunt

New Estate And Gift Tax Laws For 2022 Lion S Wealth Management

Sa May Be Forced To Cut Property Tax Rate Council Also Considering Raising Homestead Exemption

Estate Taxes Under Biden Administration May See Changes

How Can I Avoid The Massachusetts Estate Tax Heritage Law Center

San Antonio Homeowners Get A Property Tax Break As Council Raises Exemption Rate